In Britain’s House of Cards economy, growth means adding more cards

According to David Cameron, writing for the Guardian after the G20 summit in Australia, “six years on from the financial crash that brought the world to its knees, red warning lights are once again flashing on the dashboard of the global economy”. In contrast, said the Prime Minister, the British economy was growing, but still at risk because it could not be fully insulated from global outcomes. Nevertheless, he had concluded that the best way forward to guard against exposure from a downturn was to apply the same policies that had already seen the growth.

Be that as it may, the truth of the matter is that British economic growth is a phantom for all the good it does; it is a fact that exists in the statistics on paper only. In reality, hidden negating factors are the reason why there is a new phenomenon being reported by politicians of an economic “lag” whereby if the recovery never seems to be felt in the pocketbook of the working man, then it will be sure to arrive soon. This is nonsense, and surely the evidence should tell of an economy that has just not recovered. And far from Britain being safe from a recession because of Cameron’s governance, the exact opposite is in fact true. Britain’s economy is, compared with itself historically, as weak as soggy paper, and only as robust as a structure made of that material precisely because of Government policy. The other great job of work that Cameron finds he has to do is manage expectation in what will be continuing failure – the British economy is going to fail, because the measures to fix the decline are ideologically not an option for the British Government. Naturally, the insurgency of a political party that hasn’t signed up to this project will cause the sort of desperate negative reaction that UKIP is causing in the Establishment at the moment.

RT’s John Wight offers a guide to the policy that is going to create recession out of a supposed position of recovery in his own response to Cameron’s writings, and if readers would like to examine those, there will be no need to recreate the same analysis here. Cameron spoke of red warning lights being an indication of global weakness, and forgot to mention that he had slap-happily engineered his dashboard to disconnect sensors that tell all too clearly of Britain’s problems. And so the focus here is going to be on examining those signals, and looking at some aspects of the overall general ailment of the British economy.

In true Luikkerland/FBEL tradition, there must be a disclaimer that the author is not an expert in economics – not anywhere near. However, the British Government routinely uses the economy – or public perception of it – as a tool of propaganda, and anyone interested in understanding the method has to explore the subject and acquire at least a rudimentary understanding. And so, while there is an inclination to investigate, the findings may as well be published – which, it is hoped, will also increase the visibility of economic issues amongst others who may be, like the author, not in natural territory.

The latest statistics concerning the British economy showed that in the 3rd quarter of 2014 Gross Domestic Product (GDP) fell by 0.2 percentage points from 0.9% to 0.7% (source). Furthermore, in the last quarter of the year, GDP is expected to shrink to 0.5%; the Guardian article which is the source of this latter piece of data offers an explanation as to the reason why:

The pace of Britain’s recovery is expected to almost halve by the end of the year after a survey showed the service sector expanded at the slowest pace in almost 18 months in October.

What is being referred to is how growth in the service sector of the economy slumped from 1.1% to 0.7% – and, in addition, how much of an influence the service sector, which happens to be the largest constituent part of Britain’s industrial landscape (as it is, admittedly, in most Western countries), has on the entire economy for good or bad. It might be a surprise to some readers to learn that between 1948 and 2013, the service sector’s share of the economy jumped from 46% to 79%. Another unexpected detail, at least from a position of prior relative ignorance, is that this economic sector has a technical term ‘Tertiary’ – which infers a lower place on a hierarchy of economic components. Investigating more, it will be discovered that the Primary Sector (according to Wikipedia, at least) is the extraction of natural resources; its economic worth is not hard to imagine: clearly when people are engaged in this activity they are bringing forth new material which has inherent value. So whereas before the extraction there was only unrealised wealth potential, value is suddenly added afterwards. Moving on, and the Secondary Sector is manufacturing: turning raw materials into products and thus increasing the value of those materials. Then there is the service sector, which delivers services instead of tangible products – although there is a relationship between the two; services influence costs by affecting the way manufactured products are communicated between buyer and seller, and the costs of products involved in delivering services contribute to the costs of the service.

Just from an intuitive response to this information, one can see a problem arising from the fact that in the service industry, there is no base raw commodity upon which any relative added value can easily be determined – as Wikipedia puts it: “potential customers [may have difficulty] understand[ing] what [product] they will receive and what value it will hold for them”. For as far as the gauging of economic well-being with GDP is concerned, value added is the central concept. [Value added; a definition: “the value of… [the product] minus the value of goods that are used up in producing it”].

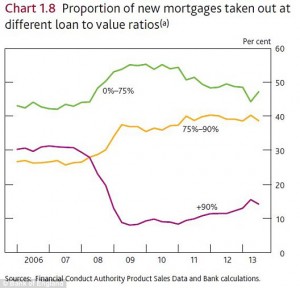

Bringing this to a point, it is perhaps reasonable to suppose that there would exist from time to time a scenario where the cost of a service product is well beyond any real value; indeed, there was a famous scenario in 2008 where financial service products suddenly had no buyers because of a discrepancy between inflated and real value (the worst financial crisis since the Great Depression ensued). This is an appropriate example because critics of Britain’s recovery suggest that it is being driven by the Coalition Government’s tax-payer subsidised sub-prime mortgage bubble. Certainly, house price rises are being attributed to this scheme, and the American experience demonstrated that price rises stimulate a desire to provide more mortgage products on increasingly easier to obtain terms.

But there is a general problem about determining value to do with how the human resource – which is the main input component of a pure service provision – must be rated. The nice answer would be in terms of quality, but in reality, with culture in general decline, value could be more a reflection of confidence and low cunning. As such, value will inevitably be subject to price fixing and arbitrary numbers that bear no relation to the quality of service. Potentially, all goods and service saleable to a consumer will compensate for inflated people costs in a service-dominated economy – and at the thick end of the wedge, shelf stackers, cleaners and coffee servers will be under paid to reduce overheads. Indeed, in the British economy, a situation has been created whereby there is a disconnect between the number of people in employment, which is the subject of much Government crowing, and added economic value. Common sense suggests that such an economy as Britain has is at risk of being wholly scam-comprised – a house of cards that inevitably delivers little return for most of its participants. This latter is certainly true and is evidenced; perhaps here then is the real reason for the “lag” phenomenon of the supposed recovery.

Corroboration of the shakiness of Britain’s service-reliant economy from officialdom is not hard to find, but one suspects it would never raise the subject of charlatanism as economic buoyancy. The following is from an April 2014 Guardian article on the comparisons between Britain’s economy, and that of other G7 nations; an unsustainable economy is explicitly connected with the distinct lack of a manufacturing component:

It is the received wisdom that in the runup to the financial crisis that hit in 2008, the UK economy was too heavily dependent on credit-fuelled consumer spending and on financial services. A shift towards more manufacturing and exports is required if a sustainable economic future is to be built.

On this matter, surely there can be no better demonstration of unsustainability than in how the British Government cannot reduce the extent to which it borrows and the extent to which it allows national debt to accrue. And it should be no surprise that it cannot act against these things when there is no spending empowerment in the service economy of its armies of lower scale operatives, as above mentioned. Zero hour contracts look good for employment statistics, but the resultant shortfall of tax revenue, and the fact that an in-work benefits claim becomes necessary for people to subsist, means that even if an economy looks good on paper, it can’t create conditions for debt-busting growth. Moreover, neither can borrowing be expected to fall when there is a large section of the service sector that depends on Government spending. The State, in partnership with private firms or charities, has invented many wholly new ways in the last few decades to provide services to people who are ill, or are dying, or who don’t speak English, or who want to organise their communities, or who don’t have work, or have learning difficulties, or can’t afford private housing. On top of all this, Britain’s open border, in relation to this service sector industry, is about importing clientele much more than it is about creating growth. (This site has previously covered the fallacy of trying to cut Government spending while borders are wide open).

Manufacturing in 2013 stood at 14% of the British economy – this figure was down from 41% in 1948. There is no political will to do anything about this appalling state of affairs because creating genuine conditions for general affluence is not the objective of the British Government. Instead, it is determined to create a control grid of micromanagement of the population and a captive consumership for corporate-government financial services (and no alternatives will be countenanced) by which another strand of control – debt slavery – has long been exercised. At the same time, Austerity – a pretence at fixing the economy – has been about stripping the middle class of real wealth through siphoning taxes straight into national loan repayments. Britons have been warned that austerity will last for years – and why not; the British Government can keep borrowing (and skimming off taxes) until Britons are poor enough and controlled enough and until a stage is reached where it will be able to afford to let those elements in the economy that aren’t valuable find their natural levels. The bubble can be allowed to collapse. The ensuing chaos will require a global solution, which will be that long-threatened cashless single currency and transnational political union. Resisting will be viewed as criminally counter-productive, and the control grid will be locked rigidly into place to deal with it. With the people impoverished, homeless, incarcerated, who will be able to do anything about it?