Taxation truly is theft: a “sitrep”

In a long running dispute between the household from whence FBEL issues forth (let’s put it like that), hereafter referred to as us/we, and the local authority (the Council), the former, as a co-defendant, has been summoned by the latter to the local magistrates court on three occasions for non-payment of Council Tax. The astute reader may have already noticed what might look like a fundamental problem in the presentation in the previous sentence, but no mistake has been made: the Council issued the summons each time, and the Magistrates’ Court administration service of this county facilitates it. This abuse of power in the first instance must be put aside as an area for combat while the British justice system won’t correct it (and the justice system may well need to be taken from the hands of the Crown in order for this to happen), but suffice it to say a council can issue a summons to a court by having a list of numbers (supposedly representing defendants) – nominally the complaint – signed by a low-ranking legal advisor in the service of the Magistrates’ Court administration (who may or may not have the authority to “issue a summons”), and then by pasting a copy of said signature on paperwork of the council’s own making. The Magistrates’ Court administration in this county writes to tell us that – and this is quite astonishing if true – “the High Court has… approved the production of a signed summons by a complainant’s computer”, however we are unable to ascertain if the legal advisors “signing” the “summonses” have been given written permission by the Justice’s Clerk. We have been given assertions about general compliance with the rules, but nothing written down can be produced (and the Justice’s Clerk won’t answer any queries).

On each occasion, a summons has resulted in a “liability order”, which the Council has used to issue an attachment of earnings order to one of our workplaces so that, in effect, the Council purloins an amount of monies before it is paid to us in wages. There are few things to clear up regarding this state of affairs before moving to the crux of this report. We never attend the Magistrates’ Court hearings because they are not in fact courts, but rather, in effect, sessions in rooms hired by the Council at a facility to impress legal propriety (i.e. the Magistrates’ Court) whereby a defendant consents to a fraud by his attendance. The Council is able to translate the resultant “liability order” into an attachment of earnings because it retained certain information about us on its databases that had been provided for other reasons and at a time that pre-dates this Council Tax saga. Although the Council Tax regulations clearly state that the information required to serve an attachment of earnings order must be obtain from the defendant through a specific enquiry, instead the Council cites emergency powers to ride roughshod through data protection legislation. Naturally, this abuse has been taken up with the Office of the Information Commissioner, which could find no fault with the Council’s conduct†.

So much for the ground upon yet the Council cannot yet be moved. However, there are two points on which a fight can be based. The first is the fact that the summons in each case is always constituted in a manner which does not conform to the Magistrates’ Court rules – this is not a surprise given that the Council manufactures them itself. A summons should bear the signature of the presiding Justice (magistrate), or bear his name, and the signature of the Justice’s Clerk, or a proxy for him (with that aforementioned written permission having been given). However, on each occasion in this case, the summons only bore one signature of a low-ranking legal advisor. In actual fact, in the first instance, the signature was presented above a title that gave an impression that the summons had been signed by a magistrate when it had not.

Neither the Council nor the Magistrates’ Court administration of this county can respond to the matter of the improperly formed summonses. The Council has had their invalidity pointed out to it in detail through its two-stage complaints process, and throughout has not been able to point to legislation whereby it can say the summonses are proper.

The second point upon which a fight might be had is that the procedure commenced by the invalid summons doesn’t actually appear to produce a valid liability order – or court order (which would be a logical expectation).

The pertinent legislation states that a liability order exists in one of two stipulated forms, depending on whether it deals with an individual defendant (or co-defendants) or a number of separate defendants. It might surprise the reader to discover that the Magistrates’ Court does not produce this liability order in either of the prescribed forms. Instead, one has to apply to the Council for a copy – and if this suggests to the reader that the Council creates an imitation of a court order (for surely the High Court has not approved the manufacture of one of these on a complainant’s computer), then this would be the correct idea to arrive at.

It appears that the Council always prosecutes in a bulk process, and provides the Magistrates Court with a list of names of separate defendants. This list is signed, and returned to the Council (although on closer inspection, any authorising signature does not necessarily appear) – and hence this is why the Magistrates’ Court administration directs enquiries to the Council for copies of a liability order. When one presses the Council for such an article, it provides a copy of the said list, redacted so that it only shows the name(s) of those requesting the data. However, because this is not a liability order as defined in the legislation, the Council obviously feels obliged to produce a document according to the correct form. Because these are certainly manufactured by the Council (who don’t appear to be used to receiving demands for proof of an order), they make for some interesting reading, being inconsistent one with the other, and often bizarre.

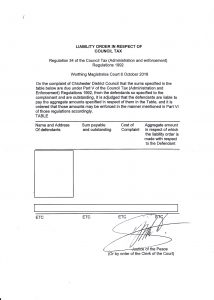

The most recent liability order that we received from the Council is reproduced below. This is not a joke, dear reader. The Council has redacted it to hide the identity of other defendants who, it claimed, are supposedly named in the document. And yet, why would it be necessary to redact the name of the defendant requesting proof of a liability order made out against him? Because of this: a real liability order naming that defendant doesn’t exist.

As it happens, the example embedded here is of the proper form (as far as the claims the Council make for it go): type B, which is for multiple defendants (for “more than one person and more than one… amount”). All of the such-like documents provided by the Council have been in this form, although the first was not redacted, but made out to co-defendants – us – for one amount. In that case, the order appears to have been in the wrong form – a bungle by the Council operative who constructed it on “the complainant’s computer”, perhaps? The second summons was redacted completely except for revealing that total fees due were £100 – the amount that an individual defendant accrues in the process. Again, and contradictorily, the Council claimed it had been redacted to hide other names. It is possible that this order, the most farcical of the three, recycled elements of a old order (in the wrong form, nevertheless), that had once been used for an individual.

The difficulty to be had in this matter is that although we are clearly dealing with a travesty, it happens to be how local authorities routinely collect taxes all over the country. When wrongdoing is institutionalised, there can only be doubling down on it. So, on paper there’s little real chance of having the Her Majesty’s justice system find anything wrong with it. Put basically, if there is no court but an unofficial kangaroo one in the first instance, then there is no higher court to which to appeal, or, the High Court cannot have jurisdiction over a confidence trick run by local councils. We are finding this out because on the latest occasion upon receiving a “liability order”, it was decided to explore what would occur if an application to state a case for the opinion of the High Court was made and pursued: basically we have been fobbed off by the Magistrates’ Court administration until such time the deadline to apply for a Judicial Review has elapsed. The reader must understand that the application to state a case to the High Court is done through the local Magistrates’ Court administration (which has been directing us to approach the court itself – despite the apparent fact that its administration is handled by the county’s central service), while the Judicial Review is done through direct appeal to the High Court. The plan now is to attempt one of these in the next cycle of this dispute.

In the meantime, either in April or March (and hopefully no later), the plan is to take the Council to a money claims court on the basis of a demand for the return of the fees accrued by its invalid “recovery” of Council Tax‡. The idea is to create circumstances whereby the Council must produce proper documentation in the case of the liability order, and it must produce justification for the form of the summons. It’s really a case of just getting into the arena to see where it will lead. And actually, it’s clear where this is going to go, win or lose in any court: exposure of deep seated, pervasive corruption, and demonstration of Government for what it really is.

† The Council will not remove the data on request either – also for spurious reasons. Another front will be opened up regarding this separate but related situation in 2019.

‡ Update 4th April, 2019: It’s been decided that it might be more cost effective to opt for the judicial review (a flat fee, value of which is known on application). It is anticipated that County Court will put a money claim on a much more expensive track because of case complexity.